Seller Financing can be a powerful tool in the real estate investing world. Both Buyers and Sellers can have huge wins by leveraging seller financing but it is not for everyone! We will cover a lot of the questions J&A Home Buyers get when working on seller finance deals: What is Seller Financing? Give me an example with numbers. Benefits to Sellers and Buyers and how to structure a seller finance deal in Texas. J&A Home Buyers buys houses all over Texas and we have several realtors on our team so if you need to sell or someone to represent you that has done this before reach out. Let’s get you what you need to know!

Key Points In this Article

- Definition- Real Estate Agreement where financing provided by the seller is included in the purchase price. This is typically from equity in the home not cash the seller has.

- There are many benefits to both buyers and sellers to make more money than they might in a standard real estate transaction. How do both sides win?

- What contracts to use to structure a seller finance deal in Texas and what third parties will be involved

- Seller Financing is not for everyone, this is what to think through.

What is Seller Financing?

In a traditional purchase transaction in Texas a buyer would approach a seller or the listing agent for that property and offer a cash offer or an offer to purchase with a loan with a pre-approval letter from a bank. In a seller financing transaction the equity the seller has in the property becomes “the bank.” Not in a literal manner but in essence the buyer structures an offer where the buyer would make a down payment followed by monthly payments of principal and interest to the seller. When the deal is accepted by both parties then a lawyer will draft up a mortgage agreement between the buyer and the seller. Once this is finalized the transaction is much like any other real estate transaction at the title company. On closing day the deed is transferred to the buyer and the seller will have a lien on the property for the amount of the loan.

Example of a Seller Finance Transaction

The buyer offers a purchase price of $300,000 and a down payment of 10% with a 3% interest rate, a 30 year amortization schedule and a 10 year balloon payment. Here is how that breaks down:

- Purchase price is $300,000 the seller will make that money but not all at once

- Down Payment is $30,000 and the buyer will need to bring that in cash to close to give to seller on closing day

- Loan ammount: $270,000 which is purchase price- Down Payment

- Interest rate of 3% is a monthly payment that slowly declines over the term of the loan the first month is calculated like this: (270,000*0.03)/12 = $675. With each payment a sum of the $270,000 loan will be paid down so the next month will have a smaller loan balance and therefore a smaller amount in interest income.

- Term of Amortization: 30 years, the loan is structured as if it were to be paid off over 30 years so the principal and interest are calculated accordingly but in this case there is a significant catch!

- Balloon Payment: 10 Years, this means that at the end of the 10 Years the buyer would need to pay off the remaining amount of the loan which is still $205,877.12! Typically they will refinance the property with another bank or pay it off in cash.

What is cool about this example is that the seller made the full $300,000 of the purchase and they made $71,853.19 in interest payments over the life of the loan. They didn’t have to pay property taxes or insurance or deal with any of the maintenance of the home during that period.

Benefits to Sellers

So what are all of the ways that a seller would benefit from a seller financing transaction?

- Speedy close: Many times a traditional lender can drag out a transaction. In a seller transaction deal it can often be done in a few weeks.

- Tax Benefits: If you were to sell a property in a cash purchase you would have had to pay taxes on all of the capital gains you have on the $300,000 property mentioned above. If this bumps you into a higher income bracket that year then a good chunk of that money will be taken by Uncle Sam. In a seller finance transaction the seller receives the money over a longer period of time which means that it may keep them in lower tax brackets each year and keep more of the total money made from the deal in their pocket.

- Better price: The buyer may be able to get a better interest rate from a seller than from a bank. At the time of writing this article interest rates for investors are around 8.5%. When an investor purchases a rental they need that property to cash flow so if they are going to put 25% down on the property the above mentioned property may only be worth $205,000 to that investor. This is a huge difference! By seller financing the seller makes interest + a much higher purchase price.

- Down Payment: On closing day the seller gets an immediate pay out with the downpayment

- Passive Income: Steady income with out the risk of owning the asset

- Asset Backed Investment: Since the property had a good downpayment the seller knows the buyer has a lot to loose if they default and if that did occur the property would go back to the original seller who carries the lien on the property. At that time the property will likely be worth more so this motivates the buyer even more to not let that happen

- Negotiating Power: By seller financing a property the seller has a lot of negotiating power in that deal as they are helping the buyer out

Benefits to Buyers

Ok, pretty cool! What is in it for the Buyers then?

- Quick Close: Short qualification time and less red tape with the banks

- Closing Fees: Banks often charge expensive fees and points which make up the bulk of a closing transaction. When seller financing this can be wiped out!

- PMI: Buyers will often pay Mortgage Insurance that insures the bank in the event of their default. This is not the case in seller financning

- Interest Rates: Buyers can often negotiate a much better interest rate with a seller as they benefit in different ways a bank would not benefit.

How to Structure a Seller Finance Deal in Texas

J&A Home Buyers always recommends you reach out to a lawyer or a realtor who is knowledgeable on how to structure these deals. There are big risks in signing a contract that you don’t understand. We have several Realtors on our team so if you need our input don’t hesitate to reach out! Of Course we buy houses in Texas too so if you are a seller we would like to learn more about your property.

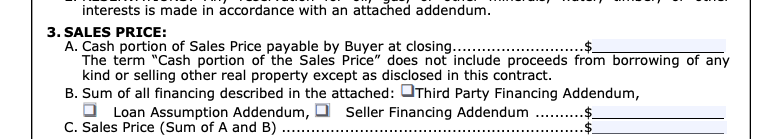

The Texas Real Estate Commission has a set of promulgated contracts on their website which in layman’s terms these are pre-written contracts for real estate. As it is a state lead initiative these contracts are built to be fair to both parties and are constantly being improved upon. As such the section numbers may change and the image might be slightly different from what we show you in this article. The example we will give is for a property that has less than four units hence the name of the contract is called ONE TO FOUR FAMILY RESIDENTIAL CONTRACT (RESALE). We use a different contract for larger multifamily buildings with 5+ units. In this section you will find a part called Sales Price. As shown below you would fill out the downpayment you will make with cash and you will fill out the amount that will be seller financed in the line below and check the box for Seller Financing Addendum. To learn how to fill out the rest of the Texas One To Four contract you can find a number of other youtube videos out there and given these change over time I recommend you look for one more recent.

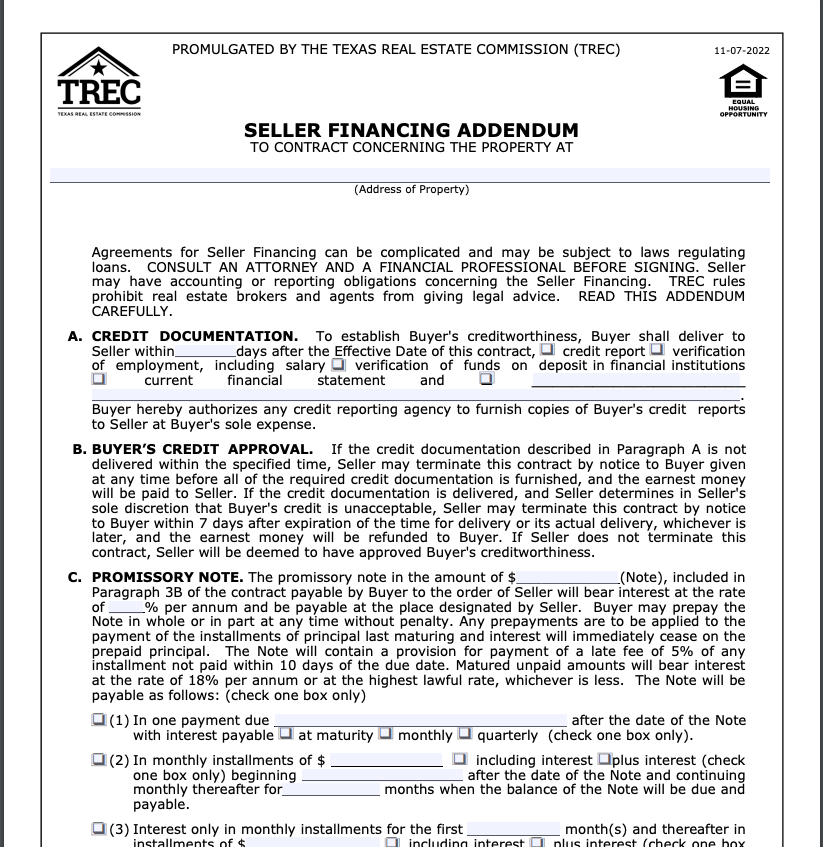

Once your One to Four contract is fully filled out you will need to find the Seller’s Financing Addendum under the drop down titled “Contract Addenda.” You will need to read through this and fill out the fields according to how you want the deal structured.

That is it! With the One to Four and the financing addendum you have all you need for an offer that is seller financed. There may be other addendums required for your particular transaction but this is what you need to seller finance. As you can see if Texas made a template contract addenda for this then it is a pretty common transaction even though it is not widely known or spoken about.

Is This For Me?

If you are a seller evaluating whether you want to pursue a seller finance deal it is important that you ask your self three questions. Does this align with my financial objectives? Do I trust the person that is making the offer? Will they be making money on this deal too? If they are not making deal you may face problems down the road and go through foreclosure.

If you are a buyer this is typically how J&A Home Buyers approaches a seller or a listing agent about a seller financed deal. We will reach out explaining how we would like to give them a top dollar offer and ask for a cup of coffee where we can talk through these details in person. At that time we will make sure they understand how the numbers work out and the deal is structured and we will also lay out for them how we plan on making that deal profitable for us which de risks the transaction for the seller.

We make every effort to make every deal be a win- win. If we can help you by purchasing your property or if one of our realtors can help you in representing you in a transaction that requires seller financing reach out to us. We are located in Katy, TX and we serve a wide area around the greater Houston, TX and Katy, TX area. If you are a seller we buy homes all over Texas, don’t hesitate to call us or fill out the form below to have one of our team get in touch with you.