Key Takeaways:

- ROI is a great tool to evaluate investment opportunities and also to measure existing investments

- ROI isn’t everything and sometimes good ROI can follow with big headaches

- Leverage with a Loan can allow you to put less into a property and over time generate better returns by allowing you to purchase more properties.

Return on Investment (ROI) is a crucial metric in evaluating the performance and potential of rental properties. Unlike stocks or bonds, calculating ROI in real estate involves various factors, including leveraging debt. In this guide, we’ll break down how to calculate ROI, its significance, what constitutes a good ROI, and how leveraging debt affects returns.

Calculating ROI for Rental Properties

ROI is calculated by dividing the gain minus the cost by the cost, expressed as a percentage:

ROI=((Gain−CostCost)/Cost))×100%

This formula provides insight into the profitability of an investment and helps investors assess its viability and performance.

Significance of ROI

ROI serves as a fundamental tool for investors to:

- Evaluate potential investments.

- Assess the performance of current holdings.

- Determine if investment goals and metrics are being met.

However, while ROI is valuable, it’s essential to consider it within the broader context of your financial plan and investment strategy. Sometimes a property with an excellent ROI comes with a lot of headaches or risks that may not be worth the ROI.

What Constitutes a Good ROI?

The definition of a “good” ROI varies based on individual circumstances, financial goals, and risk tolerance. Factors such as location, market conditions, property type, and investment objectives influence what constitutes a satisfactory ROI. I really like the Book On Rental Property Investing because in this book they walk you through several plans that can help you reach financial goals. It shows the compound power of rental property investing and the ability to be creative in reaching your goal. In summary Money is not what we are after. We are all after something like financial freedom, ability to travel, to pay for our kids college etc. Money happens to be the way that we get there. When you are determining what an acceptable ROI is for an investment you should consider what your overall plan is and use ROI to help you figure out how you will get to that end goal.

Understanding ROI Dynamics in Real Estate

Real estate ROI differs significantly from traditional investments due to factors such as equity appreciation, rental income, expenses, and leveraging debt.

Impact of Debt on ROI

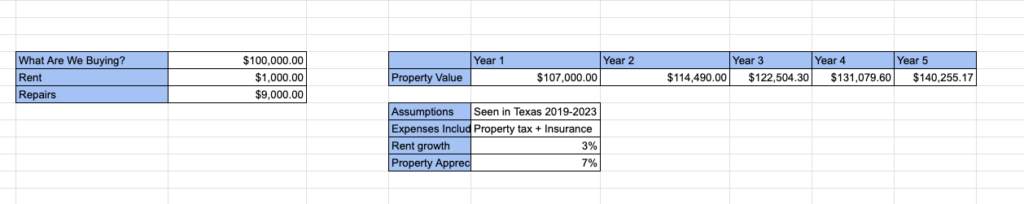

Debt, or leveraging other people’s money (OPM), can significantly alter ROI. Let’s explore two scenarios: one without debt (cash purchase) and the other with debt (mortgage). In both scenarios we are going to purchase a house for $100,000. The number is low for our market here in Katy, TX however it keeps the math simple. In the image below we see that the house will appreciate at a steady 7% each year. This is based on what we saw in Texas for 2019-2023.

This doesn’t really change if you use a cash purchase or a loan to purchase.

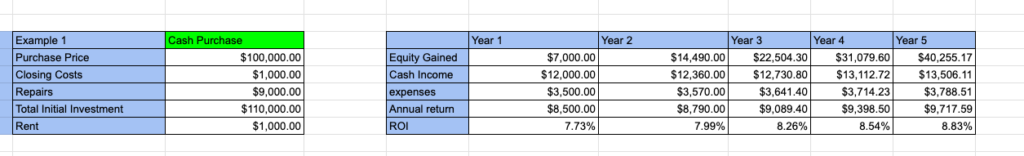

- Cash Purchase: Involves higher initial investment but lower expenses. ROI calculation focuses on equity gains and rental income. As you can see in the image above this house yields about a 7.7% initially and over time the percentage goes up.

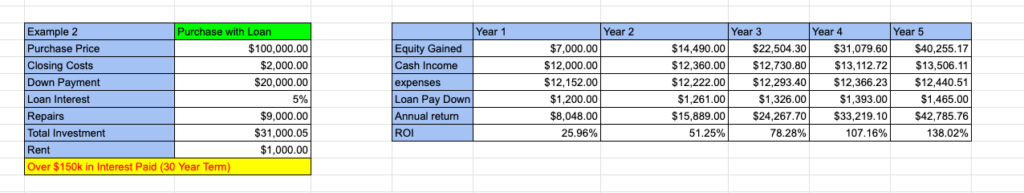

- Mortgage Purchase: Requires lower initial investment but incurs interest payments and higher expenses. However, leveraging debt can amplify returns over time due to equity appreciation on a smaller downpayment and tenant rent payments paying off your mortgage debt each month adding to the principal you hold as equity. Although you will pay the bank a significant amount more for the property in interest payments the ROI is much higher due to the lower amount of initial capital investment. In this scenario you could purchase three houses for the same amount of money as the as the cash example above.

Although we don’t show this in our example there can also be tax benefits that help you realize more of your ROI than you may find in other investments. Tax benefits will vary a lot depending on your personal circumstances so we recommend you reach out to your tax advisor to discuss how you can meet a plan and how taxes may benefit you in real estate investing.

Rich Dad Poor Dad is a fantastic book that explains the benefits of using debt in investments and how this can help generate wealth. The majority of investors I have met have read this book at some point and called it a defining book that got them into the game of becoming a real estate investor. It convinced my wife to let us dive into the world of REI!

Conclusion

Understanding ROI is essential for successful real estate investing. By comprehensively analyzing ROI metrics and considering factors such as leveraging debt, investors can make informed decisions and maximize returns on rental properties.

Leverage could significantly alter your investment plans and generate a higher ROI. Make sure you evaluate your risks as well when seeking investment opportunities.

Remember, while ROI is a valuable metric, it’s just one aspect of a comprehensive investment strategy. Always consult with financial advisors and tax professionals to tailor investment approaches to your unique financial goals and circumstances.

For more insights and practical guidance on real estate investment strategies, connect with J&A Home Buyers, based in Katy, Texas, and explore their resources and expertise. Let us know how we can help you get your deal done!